cryptocurrency tax calculator us

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. This is a simplified calculator to help you calculate the gains of your cryptocurrency.

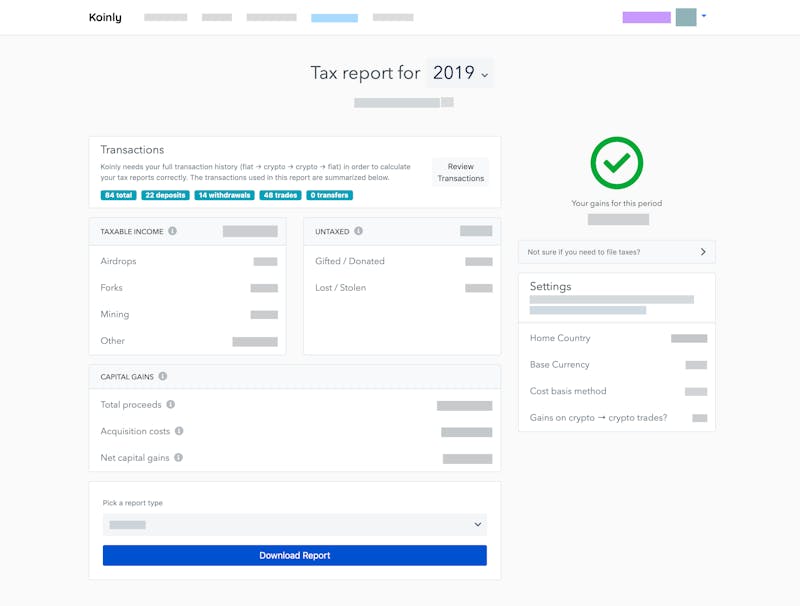

How To Calculate Cost Basis In Crypto Bitcoin Koinly

0 15 or 20 tax depending on individual or combined marital income.

. You should declare your entire cryptocurrency income under all circumstances. This will depend on. The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and l ong term capital gains.

These are the basic steps of using a crypto tax calculator. 15 Best Crypto Tax Softwares Calculators in 2022. If you requested an extension youll have until Oct.

Long-term capital gains. As per the IRS cryptocurrency or any virtual digital transactions are taxable by law just like transactions in any other property if you gained. However even though interest in cryptocurrencies continues to expand and the IRS has provided.

Sunday May 22 2022. Try It Yourself Today. For crypto assets held for longer than one year the capital gains tax is much lower.

Verify that all historical data has been imported and that your crypto taxes are calculated. Let us do that for you. The first and immediate step you need to do while working on calculating your crypto taxes is checking the market value equal to fiat currency when you initially receive the coins.

Gains and losses are calculated in your home fiat currency like the US Dollar to help you file. In 2014 the IRS decided to treat cryptocurrencies like stocks and bonds rather than currencies like dollars or euros. Invest in cryptocurrency through your Individual Retirement Account IRA or 401-K.

To illustrate if 1 BTC basis 5000 was exchanged for 10000 units of ADA and 1 ADA 060 the taxpayer will need to recognized gain in the amount of 1000 10000 x 060 5000. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code. Get Started for Free.

You can use this calculator to get a quick estimate of the taxes you may owe in 2021 on your cryptocurrency gains. Determine your crypto gains and crypto losses. What is a Crypto Tax Calculator.

Make sure the sale date is within the tax year selected. Simply The 1 Tax Preparation Software. According to a May 2021 poll 51 of Americans who possess cryptocurrencies did so for the first time in the previous 12 months.

November 12 2021 May 20. How To Avoid Capital Gains Tax On Cryptocurrency. As a result you got a 1 BTC on the 1 st of march.

Derive your estimated gain or loss Determine the estimated capital gains taxes. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. We tolerate this kind of Free Crypto Tax Calculator graphic could possibly be the most trending subject in the same way as we ration it in google improvement or facebook.

Divide the initial investment amount. The popularity of cryptocurrencyBitcoin investments continues to skyrocket. Using this calculator you can.

Apply for cryptocurrency loans. Free Crypto Tax Calculator for 2021 2022. You can discuss tax scenarios with your accountant.

The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and long term capital gainsThe calculator is based on the principle of taxation enumerated by the IRS in the latest notice. Import all your cryptocurrency exchange trade history as well as any transactions made off-exchange. Take the initial investment amount lets assume it is 1000.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Use code BFCM25 for 25 off on your purchase. In this scenario your cost basis is 10000 and your gain is 5000.

Lets talk about how to calculate tax for cryptocurrency as well as a couple of ZenLedgers Bitcoin tax calculator features that make us unique. For example you started mining one year ago. Currently CryptoTaxCalculator single-year plans cover all tax years from 2013-2021.

The purchase date can be any time up to December 31st of the tax year selected. But how much tax do you have to pay. Here are a number of highest rated Free Crypto Tax Calculator pictures on internet.

April 18 was the last day to file your 2021 taxes or request an extension to file. 1 Calculate Your Cryptocurrency Income Tax. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

You simply import all your transaction history and export your report. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. We identified it from obedient source.

Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

The way cryptocurrencies are taxed in most countries mean that investors might still need to pay tax regardless of whether they made an overall profit or loss. They calculate your gains or losses and automatically populate tax reports with your data. In the United States and many other countries you can file a capital loss deduction if you lost money trading cryptocurrency in any given tax year.

In this article we go over the main features of a cryptocurrency tax calculator. The original software debuted in 2014. The taxpayers total net capital.

Your total capital gains for the entire the tax year including gains made from non-crypto trading - the more you made the higher your tax. They compute the profits losses and income from your investing activity based off this data. Heres an example of how to calculate the cost basis of your cryptocurrency.

The character of this gain is dependent on the holding period of the original currency in the hands of the taxpayer. Satisfaction Support. Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms.

Valid from 1126 to 1130. Its submitted by paperwork in the best field. To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or.

We offer full support in US UK Canada Australia and partial support for every other country. Upload your trade deposit and withdrawal data for each account and let us create your digital currency tax reports. You can discuss tax scenarios with your accountant.

Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax calculators and talk in-depth about crypto taxing.

Start for free now. Hire a certified public accountant familiar with cryptocurrency. Enter the sale date and sale price.

The calculator is based on the. Enter the purchase date and purchase price. Migrate to cryptocurrency tax heavens.

Your gain is the amount youll be obliged to pay taxes on. Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give you an estimate of how much your sales will be taxed and much more. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

The resulting number is your cost basis 10000 1000 10. Calculate your cryptocurrency taxes and get your IRS compliant tax reports. You simply import all your transaction history and export your report.

Best Crypto Tax Software Top Solutions For 2022

5 Best Crypto Tax Software Accounting Calculators 2022

Cryptocurrency Taxes What To Know For 2021 Money

10 Best Crypto Tax Software In 2022 Top Selective Only

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Capital Gains Tax Calculator Ey Us

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Bitcoin Tax Calculator Taxact Blog

Cryptocurrency Tax Calculator 2022 Quick Easy

Calculate Your Crypto Taxes With Ease Koinly

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Calculator The Turbotax Blog

How To Calculate Crypto Taxes Koinly

Cryptocurrency Tax Reports In Minutes Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes